What were you doing in March 2009?

A look a one investor’s experience of the credit crunch and its aftermath

Ten years ago this week, I had one of the most important meetings of my career to date.

It was so confirmational to the fundamentals of a proper investing process and seeing it in action, that I tell the story almost every time that I explain how Navigator’s investment process works. I may well have told you about it before, but the lesson it teaches is so critical that I make no apology for retelling it.

Cast your mind back ten years to March 2009.

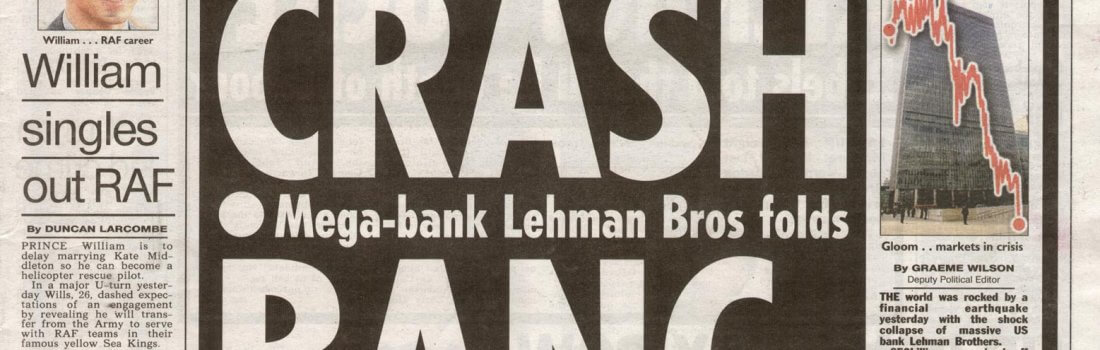

Even the youngest reader of this blog will remember the carnage of the collapse of the credit bubble that inflated through the “noughties”, not to mention the accompanying crash in property values from which we haven’t yet fully recovered, and may never do.

Bear Sterns, Lehman Brothers, RBS, Anglo Irish, the near collapse of the banking system in Iceland and Ireland: we all remember the panic that swept the financial world, and resulting freefall of world stock markets. We ought to remember it, because we lived through it and suffered from it.

I remember an office in Belfast. I remember having to tell one of my best clients that, yet again, his investment portfolio had gone down in value; this after having had the unpleasant experience of it happening six months previously, and the six months prior to that. The thing about such conversations with people with large portfolios is that, although the percentages are no different, the numbers are a bit scarier – we were talking about a six-figure drop in each of those six-month time periods.

It isn’t funny when that happens. For anybody.

Understandably, my client was concerned about what happens next, and was wondering if he should sell everything to cash and wait for things to get better.

The problem with doing that is that selling when the market is down is a very final act. It turns a temporary decline in value into a permanent loss.

The next problem is that the right answer is to do something even more uncomfortable, more counter-intuitive. I was asking him to sell some of the defensive assets in his portfolio, the very thing that had stood between discomfort and disaster, and to buy more of the assets that had caused the decline.

The meeting lasted about an hour and a half. I wouldn’t say that my client was happy at the end of it, nor would it be accurate to say that we were in complete agreement, but I remember his words very clearly. He said, “David, I have to say that I am very uncomfortable with the situation, but I am going to trust the system.”

It is quite possible that that difficult decision was one of the most financially significant of that man’s life.

Why?

It so happened that our meeting took place within a few days of what turned out to be the bottom of that particular market crash. Did I know that? No, of course not; however by doing everything we can to make sure that people stay the course, we give them every chance of being there when the bottom of the market turns.

What happened next has turned out to be the longest bull market in history – a sustained period of market growth, albeit punctuated by small drops from time to time, some of them deeper and longer than others.

The practical result that was that, having agreed to rebalance our client’s portfolio (the aforementioned selling of assets that had held up, and buying of ones that had gone down), when we next reviewed his situation in September 2009, he had recovered all of the losses of the previous two years and was back in profit.

Since January 2007, the UK stock market has gone up by 83%, including the temporary decline through the credit crunch. But here’s an uncomfortable fact for those that think they should wait until the market steadies itself and then climb back on: nearly 51% of that rise happened between March and September 2009, which is a very short space of time. Had my client sold to cash and crystallised his losses, with a view to waiting on the market settling down, by the time he had got back in, most of the gains would have been made, and his short-term reduction in value would have been lost for all time – a temporary decline would have been turned into a permanent loss.

It is one of those immutable laws of the universe that you’ve got to be in it to win it. Investing is no different.

You simply have to got to be there when the action is happening, and that means sticking with it through the bad times, however uncomfortable that may be, so that you get to enjoy the good times – because come around they will.

David Crozier CFP

Chartered Financial Planner

All figures, source Financial Express. FTSE All Share Index 01/01/2007 to 07/03/2019 and 09/03/2009 to 30/09/2009. Please note that past performance is not a guide to the future, the value of an investment and the income from it could go down as well as up. You may not get back what you invest. This communication is for general information only and is not intended to be individual advice. It represents our current understanding of law and HM Revenue & Customs practice. You are recommended to seek competent professional advice before taking any action.