What really matters?

Investing is for the long term, and investors should focus on the things that matter and that they can control

As the Brexit drama drags on from day to day and week to week, with still no definite outcome in sight, one of the most common questions we are getting at the minute is, What are you doing about it?

I have written about this before, so you know the answer, which in short is, Nothing!

Of course, that is an oversimplification – let me remind you of what we do, our “why”, which is repeated on every email we originate, and in as many of our communications as is practical: “We believe that the most important thing right now is what you want to do, which is why we help you plan & build a future that is well organised and under control, giving you every opportunity to get the best from yourself.”

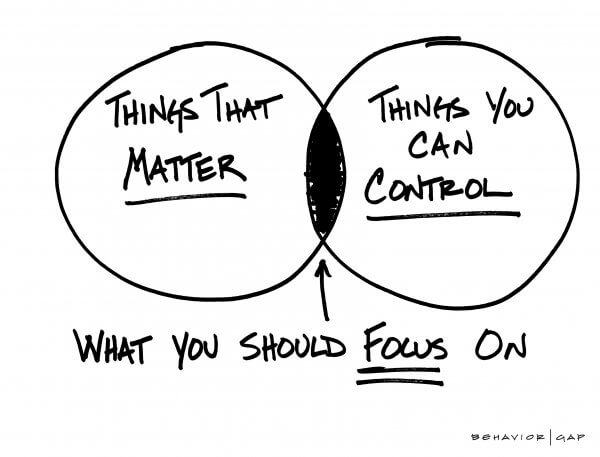

Working out what things are important to you, and what would just be “nice to have”; building a costed and realistic financial plan that give you a road-map to your objectives; how much money you save each month; the risks inherent in your investment portfolio; the costs of your investments; the tax you pay.

These are all things that matter – massively! – and they are all within your control, to a greater or lesser extent.

In contrast, nothing you or I can do can influence – not even in the smallest way – what happens about Brexit, US-China trade wars or the ongoing row between the US president and congress; nor can we control or predict the direction of markets as these issues unfold.

Do they matter?

In the long term, I would contend that they really don’t matter. There will always be “events, dear boy, events”† that affect what happens to markets in the short term. Sooner or later, the weight of capital will re-exert itself and markets will move gradually higher. There have always been such events and there will continue to be. Investors just need to have the discipline to hold their nerve through it all.

It is worth noting that both the FTSE All Share and MSCI World indices are both up by more than 5% since the start of the year±. I am not suggesting that this is in an indication that we are out of the woods, or that markets can’t go back down again – of course there is always that possibility. But I always find it interesting that the media are very quick to highlight when markets fall, but are less eager when they make gains.

We will be addressing some of the practical things that businesses and investors can be doing to deal with the specific issue of Brexit at our Brexit at the Border event on 27th February. If you would like to come and have yet to book, full details and tickets are available here.

As ever, please do speak to myself or one of the team if you have any queries about the issues raised in this blog post, or indeed any other financial planning matter.

Kind regards

David Crozier CFP

†Often attributed to Harold McMillan, but apparently he never said it

±31/12/2018 to 4/2/2019 FTSE All Share 5.1%, MSCI World 5.44%. Source: Financial Express Analytics

Please note that past performance is not a guide to the future, the value of an investment and the income from it could go down as well as up. You may not get back what you invest.

This communication is for general information only and is not intended to be individual advice. It represents our current understanding of law and HM Revenue & Customs practice. You are recommended to seek competent professional advice before taking any action.