The First Pound

Take advantage of the magic of compound interest

I hope you enjoyed your Christmas and New Year. With all the festive cheer, the best present was our new granddaughter, Phoebe. Obviously, we want to give her something, and we’ve decided to start a pension for her.

Is that a thing, do I hear you ask? Oh yes, absolutely! Anyone can contribute up to £3,600 a year to a pension. I won’t even have to cough up the full amount – tax relief will contribute 20% of the total amount, so that I will only need to contribute £2,880 (or 80% of whatever gross amount I decide).

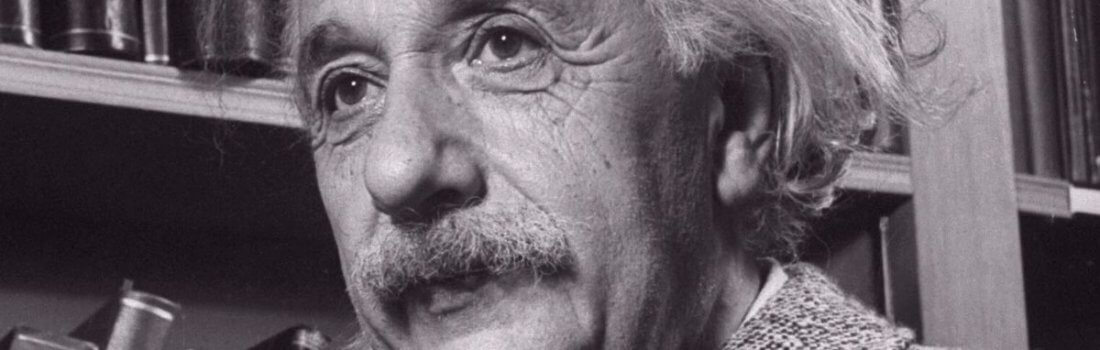

Compound interest – which Albert Einstein† called the eighth wonder of the world – means that the most valuable contribution to any form of saving or investment is the first one. As the fund grows, it’s not just the capital that is being added to; growth gets added to growth and the whole thing starts to increase exponentially, not just in a straight line.

Let’s say that I contribute £3,600 to Phoebe’s pension from now until I am (say) 80. At that point Phoebe will be 23. If she contributes not another penny to the pension, it could be worth nearly £900,000 by the time she is 57*.

Driving home the point, if she was to only start contributing at age 23, in order to accumulate the same fund at 57 she would have to contribute nearly £9,900 a year.

Those calculations have to make some assumptions, of course, and inflation will have a big effect, but what applies to one set of numbers, also applies to the other. The message is clear – starting early makes a huge difference to any form of investment programme.

It reminds me of a Chinese proverb, ‘The best time to plant a tree was 20 years ago. The second best time is now.’

One other thing may occur to you. Given that I am 57, and that as the rules now stand, Phoebe won’t be able to access her pension before she is 57, it seems unlikely (although it is not in my hands±) that I will live to see her benefit from it.

The older I get, the more I appreciate this quotation: ‘The true meaning of life is to plant trees, under whose shade you do not expect to sit§.’

As ever, if you need to discuss anything arising from this note, or you have any other questions or financial issues we can help you with, please get in touch, and one of the team will do our best to help.

Kind regards

DC

†Allegedly, although there is no evidence that he actually said it. But it’s still true, even if he didn’t.

*Assumes 5% growth each year. The purchasing power of the figures quoted will be eroded by inflation. Growth may be higher or lower than this, and is extremely unlikely to be the same amount every year. Any investment can go up or down in value, part performance is no guarantee of what might happen in the future, and you may get back less than you invested.

±Epistle of James 4:15

§Nelson Henderson, publisher and Scottish rugby international