Small Earthquake in Chile. Not Many Dead.

Long-term growth of equity investments tends not to get reported as much as short-term drops, but that doesn’t mean it isn’t happening

During the 1930s, the sub-editors of the London newspapers ran an ongoing unofficial competition to see who could get the most boring headline printed. Claud Cockburn of the Times, who seems to have had the idea for the competition, only won it once, with the headline that appears as the title to this blog*.

The point is that news that is not surprising, and especially good (or less bad) news, isn’t news – at least not in the eyes of the mainstream media – and therefore tends not to get reported.

That’s why you are very unlikely to see a headline that says, Billions added to value of shares.

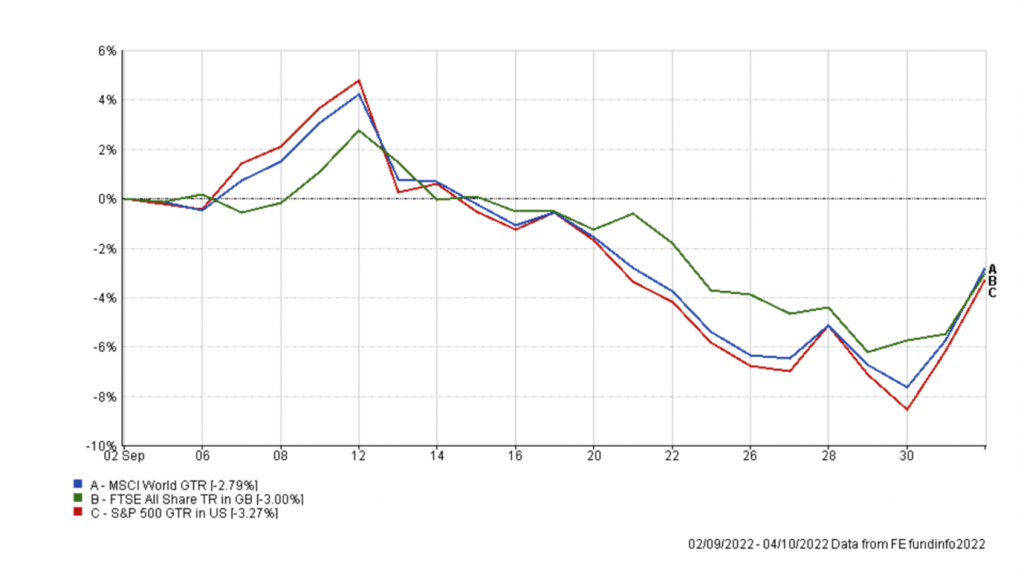

But that is nonetheless exactly what happened this week. All the major stockmarket indices that we use in our portfolios experienced a significant recovery, after an admittedly disappointing September.

There was little coverage of this in the non-financial news, whereas the downturn was, as is the way with these things, well reported in the media.

Concentrating on short-term performance of shares is unhelpful, and this is as true of short-term good performance as bad. By the time you read this, this week’s uptick in value could easily have gone the other way.

Even with all that has gone on this year – war in Ukraine, the resulting jump in the price of gas and oil, interest rates and inflation at levels we haven’t seen for ten years or more, exacerbated by the flood of money that was poured into the world economy during covid and even before – even with all of that, world markets are well above where they were even two years ago.

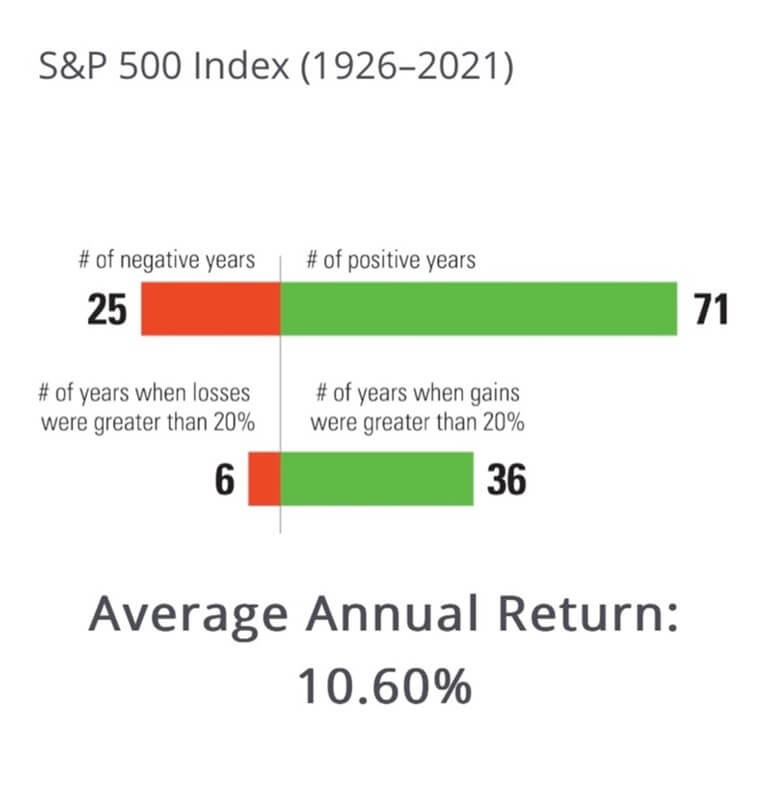

In the short term, stuff happens and markets react to it. Nobody knows what will happen tomorrow, nor how markets will behave. What we can say, with good evidence, is that markets go up on more days than they go down. The following shows data from a US index, the S&P 500, but the principle applies in general.

There are a couple of ways to look at this but the main message for me is that if I wait until tomorrow to invest, it is more likely than not that the market will have gone up, and consequently it is more likely than not that I will have lost out on an incremental gain over and above what I will earn by owning the market for the long term.

Timing the market – or trying to – is dangerous. Time in the market – accepting that fluctuations will happen and that it’s worth it to get the benefit of the long-term return – is the only sensible way to think about investments. Not only does it have a theoretical basis, but it has actually worked in practice over many years.

Next time you don’t see a headline that says markets have gone up, remember that is nonetheless what is happening quietly in the background. It doesn’t have to be dramatic – day-by-day profits, turning into semi-annual and annual dividends, feeding into long-term growth of the great companies of the world isn’t newsworthy, but it certainly is great news for investors in those companies, provided they stick with it.

As always, if you have any questions about this article, or if you need to discuss your financial situation, please get in touch. We will do our best to help.

David Crozier

Chartered Financial Planner

*Claud was a bit of a cynic. The other quotation attributed to him is, Believe nothing until it has been officially denied.

Important notes

Investments in real assets can go down as well as up, and up and you may not get back as much as you invested. Past performance is no guarantee that this performance will be repeated in future.