Keep calm and carry on

Now that the government has put in place measures that are unprecedented in peacetime, it does seem appropriate to trot out the above oft-repeated mantra from World War 2.

We are living in times that none of us have experienced before, and there is absolutely no doubt that it is alarming. I have experienced situations in the past when people were worried about their finances, and this is without question a feature of the current crisis, but people are now worried about their physical health too. Taken together, it’s not a lot of fun, but I have a few charts and pictures for you, which I hope will help put things into a little bit of perspective.

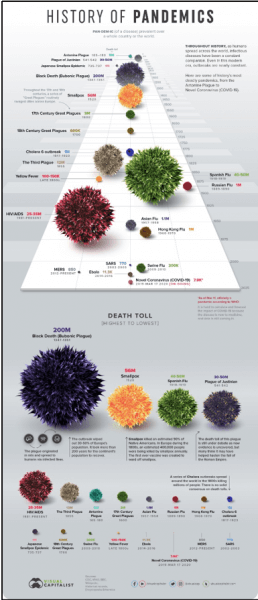

The first is a list of all the pandemics we know about throughout recorded history.

I know that COVID-19 hasn’t finished yet, and it would appear that we have a way to go before we are out of the woods, but it is clear to see that it is nowhere close to being the biggest killer. That dubious honour goes to the Black Death in the 14th Century, which is estimated to have wiped out between 30% & 60% of Europe’s population.

It’s not even the worst plague in recent history, with deaths from Swine Flu and HIV-AIDS dwarfing the damage from what is going on now. Here’s a link to the full article, which is interesting for people like me who enjoy history.

While I do not want to take away from the seriousness of the current situation, it does appear that the worst is over in China; hopefully the recent guidelines in the UK to stop contact between people as far as possible, will limit the spread of the virus here, and we will have a similar experience here.

Plus we do know what this disease is, we have medical techniques in our armoury that weren’t available a century ago, and we are continuing to develop ability to use genetic engineering to help in the manufacture of vaccines. That wasn’t available even a decade ago in the way it is now.

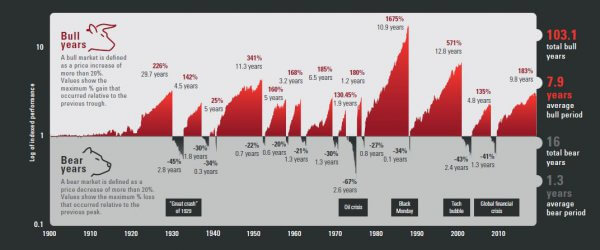

The next chart (for which I am indebted to the folks at Vanguard §) addresses the financial side, and shows two things:

One is that downturns are a feature of markets: they are not an aberration, they are not out-of-the-ordinary, they happen quite frequently. Therefore, they are to be expected. Exposure to volatility and frequent falls in value, some of them severe, are the price we pay for the long term growth of our wealth over and above inflation, and in excess of bank interest.

The second thing it shows us is that every time there has been a sharp drop in the price of UK shares – a bear market – it has been followed by a prolonged period of rising share prices – a bull market – that far outweighs the earlier fall.

Of course, there is no guarantee that this time will be the same, but think about this: when the worst is over, whether that be three weeks, three months, or three years, people will need to buy food and clothes, and they will want to go on holiday and change their cars. I suspect, as with every upheaval like this, the way we do some things will change – hopefully for the better – but the basic human instinct to improve one’s lot will not change.

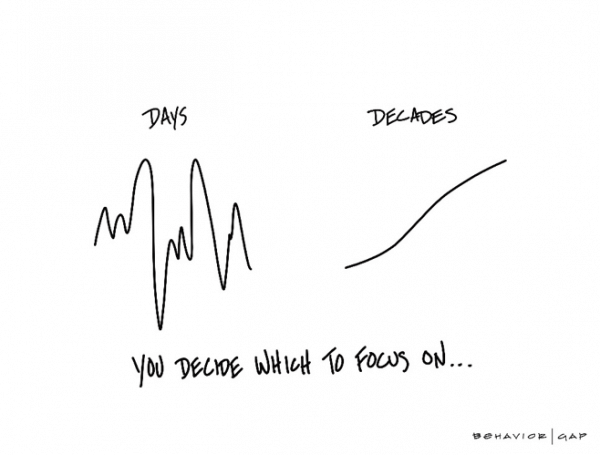

“The investor who says, this time is different, has uttered among the four most costly words in the annals of investing.”† And finally, a cartoon from financial planner and artist Carl Richards, of the Behavior Gap¥.

Your financial plan is a long-term strategy, looking decades into the future, if we are all spared±. I have no intention of letting that be derailed by what’s happening over the course of a few weeks or months.

But do please do let us know if you have any queries or concerns. That extends to letting us know if you are feeling unwell and don’t have anyone else to talk to. And if you have family or friends that are worried about their finances and don’t know where to turn, please put them in touch – we’ll help if we can, even if it’s just a listening ear.

And above all, stay safe! Your health and wellbeing are more important than anything else we could be talking about.

† John Templeton ¥ There’s plenty more excellent drawings on Carl’s website, if you’re interested.

± James 14:15

Please note that past performance is not a guide to the future, the value of an investment and the income from it could go down as well as up. You may not get back what you invest.