If you can keep your head…

David Crozier

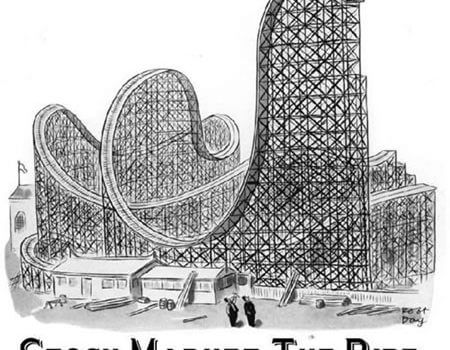

We are, once again, at one of those points in time that come along with annoying, but unsurprising frequency, when investments in real assets are taking a bit of a battering. All the major markets are down in the last six weeks, as investors give in to their fears about Brexit, about world trade, about global instability, and who knows what else. There is no doubt that some of these fears are justified, but history shows that the knee-jerk reaction of joining the herd is almost certainly a bad idea.

I say ‘unsurprising’, because just looking at the statistics we would expect equity investments to show a loss roughly one year in four, on average. We have been here before, and there truly is nothing new under the sun†.

Consider this gem of wisdom from Nick Murray: “All equity market declines are temporary, and eventually give way to the resumption of permanent advance. Permanent loss in a well-diversified portfolio is always a human achievement of which the market itself is incapable.”

Stating this another way, the only way to turn a temporary decline in value into a permanent loss is by selling when markets are down.

Markets do recover, and they usually do so with surprising rapidity and suddenness. It is not enough to come out of the market at the right time, you have to be able to guess correctly when to go back in. Both of these are much, much easier said than done.

The phrase “diversified portfolio” is important here. Holding a range of different assets is important, not just geographically spread, but using different types of assets too: fixed interest and property, as well as equities.

A couple of figures might help here. In the last few weeks*, the FTSE All-Share index is down 7.12%, whereas the Navigator Prudent Portfolio is only down 3.85%. So, unlike the Wicked Witch of the West, we are not defying gravity, but having a spread of assets can help to reduce its effects.

That’s the short term – what about the long term? If we go back to the last time we had a severe market crash, a salutary lesson can be learned. From the end of August 2007 to March 2009±, the FTSE All Share declined by 42%, which would have been hair-raising; but for those who hung in there, that turned into total positive growth for the 11 years from August 2007 to October 2018 of 76.98%±, even including that scary drop.

But it doesn’t have to be that frightening – in the same two periods±, the Navigator Prudent Portfolio only went down by 20% compared with the market’s negative 42%, and over the same 11 years delivered a total return of nearly 73%, thus showing that a diversified portfolio can reduce volatility without necessarily affecting performance all that much.

My favourite quotation at moments like this, which I have used before in these emails is from Rudyard Kipling:

“If you can keep your head when all about you

Are losing theirs…”

The iconic poem closes with, You’ll be a Man, my son, but it could just as easily be paraphrased, in the context of investments, You will stay rich, my friend.

Having said all that, I do appreciate that ‘these are the times that try men’s souls’≠ so please, as ever, feel free to get in touch with any concerns you may have. We are, as always, here to help.

*Source: Financial Express Analytics, 24/08/2018 to 15/10/2018.

±Source: Financial Express Analytics, 31/08/2007 to 03/03/2009 and 31/08/2007 to 15/10/2018.

≠ Thomas Paine 1776

Please note that past performance is not a guide to the future, investments can go down as well as up, and there is the possibility that you might get back less than you invested.