History’s hinges

David Crozier

Investing for the long term requires disciplined behaviour and faith in the future

This last blog of 2018 was prompted by a book recommendation and a presentation. Both were affirmations of some core principles, much-needed in the difficult times in which we are living.

For somebody who is personally interested in politics, as well as being professionally rather more than interested in money, the ongoing drama around the Brexit negotiations has been at once fascinating and a bit frightening. The ancient Chinese are reputed to have a curse that said, “May you live in interesting times,” and I have understood the force of that in these days and weeks.

I wonder if the Prime Minister feels as if she’s experiencing her own, very personal Chinese curse: “Theresa May, you live in very interesting times”.

It is easy to get sucked into the doom and gloom of it all, but in fact, taking the long view, people alive today, to paraphrase another PM≠, have never had it so good.

The book, Factfulness, by Hans Rosling±, explains that on just about every measure, the world is a much better place than it was even 20 or 30 years ago. The strides that have been made are simply astonishing, but the other amazing thing is that very few people grasp it. This includes some of the official bodies that are supposed to care about these things, and that count among their number some of the most intelligent and powerful people in the world.

Just to take a couple of examples out of the 19 presented in the book: poverty (almost halved over the last 20 years), education (90% of girls of primary school age worldwide are in school), access to protected water sources (88% – up from 50% in 1980) and life expectancy (72 years, for the world on average) – these are all much, much better; yet because of our natural tendency to notice bad things more than good, and selective reporting by activists and the media, we think things are worse than they really are.

Read the book, and be uplifted.

The presentation was by my good friend, David Jones, of Dimensional Fund Advisors, who has come up with a brilliant way of demonstrating that market downturns are, of necessity, temporary in nature.

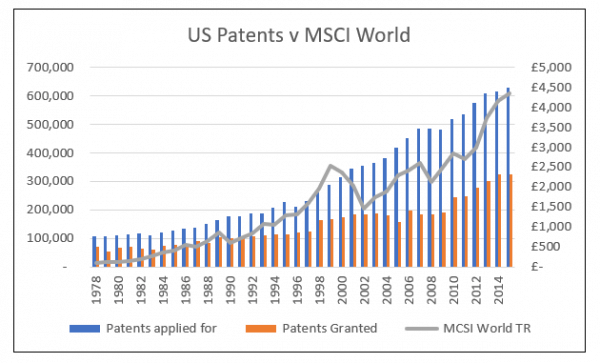

Consider this graph†.

You will notice that the number of patents applied for and granted rose steadily throughout the period, regardless of what was happening in markets. David makes a couple of points:

- The creative spirit is not affected by markets. People continue to have bright ideas; they don’t say, The market is down, I had better stop thinking;

- Once granted, these ideas need to be turned into reality. They need to be designed, manufactured, marketed, delivered – all of this, every single link in the chain, needs capital;

- Where does capital come from? The capital markets, which require a return from the capital invested; and thus markets trend ever upwards.

Because of all this, although there is no denying that markets will go up and down all the time – sometimes in a quite terrifying manner – there is a force that drives them inexorably upwards over the long term.

You just need to hang around for the ride.

Although it is not the direct point I wish to make, you will also notice that £100 became almost £4,500 in the course of a little under 30 years. Time in the market really does work, if we have faith in the future and a disciplined and diversified approach to investing, backed up by a proper financial plan to make sure that we have enough money to pay for the things that are really important to us.

This a good time of the year to reflect that the hinge of history is on the door of a Bethlehem stable*, and perhaps if we all took better account of all that is bound up in that message of hope, we would worry less about the history being made before our very eyes.

As usual, we have made a donation to a couple of local charities (Newry Hospice and Kilkeel RNLI station this year) rather than sending Christmas cards, so I would like to take this opportunity to wish you a peaceful Christmas and a happy and prosperous 2019, from all of us at Navigator.

Best wishes & kind regards

David Crozier CFP

≠Harold McMillan, July 1957

± ROSLING,H, Factfulness, 2018

†Sources: Financial Express Analytics, MSCI World, total return, increase in value of £100 from January 1978 to December 2015; US Patent & Trademark office. Costs would have reduced the total amount received.

*Ralph W Sockman

Please note that past performance is not a guide to the future, the value of an investment and the income from it could go down as well as up. You may not get back what you invest.

This communication is for general information only and is not intended to be individual advice. It represents our current understanding of law and HM Revenue & Customs practice. You are recommended to seek competent professional advice before taking any action