But Brexit…

Don’t be tempted to fiddle around with a portfolio’s structure to try to position it for potential short-term global events, such as Brexit

Summary

There is always a temptation to fiddle around with a portfolio’s structure to try to position it for potential short-term global events, such as Brexit. Investors would do well to remind themselves that the core tenets of good investing hold true through all market conditions. It is also worth remembering that the efficacy of a portfolio’s strategy should be judged not on the post-event outcome, but in terms of the quality, validity and prudence of its construction discipline in the face of future market uncertainty. Portfolios are well-structured around inalienable investment truths, particularly the value of deep diversification.

If it ain’t broke, don’t fix it…

‘One cannot judge a performance in any given field (war, politics, medicine, investments) by the results, but by the costs of the alternative (i.e. if history played out in a different way).’ Nassim Nicholas Taleb – Fooled by Randomness

Investing the Amazon way

Jeff Bezos, the well-known founder of Amazon, was recently asked a question about what’s not going to change in the next few years and how that will affect his business, which is an interesting lens through which to view things. He suggests that answering this question is potentially far more important than looking at what is going to change in the future, as it provides a foundation on which to build a robust business strategy. His response was as follows:

‘In our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection. It’s impossible to imagine a future 10 years from now where a customer comes up and says, “Jeff I love Amazon; I just wish the prices were a little higher,” [or] “I love Amazon; I just wish you’d deliver a little more slowly.” Impossible.”

He then continues:

‘When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.’

Bezos is right. His wisdom applies not only to Amazon but also many other spheres, not least investing. Despite the lack of clarity about what might happen in the global economy, in political circles and in financial markets, we know certain things work to the benefit of sensible investors.

The inalienable long-term truths of investing

Irrespective of what might happen in the future – including any of the potential permutations of Brexit – as investors we can rely on a number of truths: markets work pretty well and are hard to beat, so capturing the market return on offer using lower-cost, well-structured products makes good sense; spreading our assets broadly to ensure the risks we face are well-diversified will always sit at the core of a successful long-term strategy; balancing out the risks of equities by owning high quality bonds provides a good insurance policy; being patient (living through the short-term dips) and being disciplined (maintaining your philosophy and strategy over time) are fundamental to achieving the returns you need to fulfil your financial goals.

At this point – given the short-term uncertainty, and possible anxiety, over Brexit – let’s focus in on diversification.

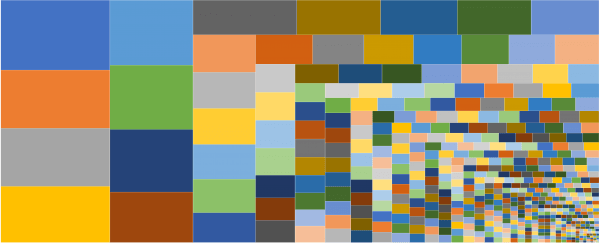

Remaining broadly diversified protects us from specific unfavourable outcomes

There are many ways in which an investor can be diversified, from individual securities to sectors, countries, investment styles and assets classes. Owning a portfolio that includes many thousands of companies, all market sectors, spread across developed and emerging economies, reduces the risk of being caught out by material negative impacts in specific markets, such as the UK. Take a look at the charts below. The first represents the UK market and its underlying holdings. It is worth remembering that the UK only produces around 3%-4% of global GDP and represents about 5% of global equity market value. As you can see, a few names dominate e.g. HSBC (the big blue rectangle in the top left corner) weighs in at 5.3% of the broad UK market.

Figure 1: The UK market is highly concentrated

Data source: Morningstar Direct © All rights reserved. FTSE All Share holdings.

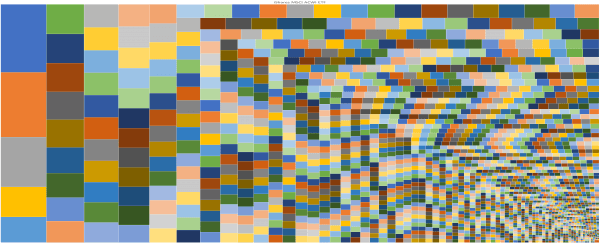

In contrast, a market-capitalisation weight to stocks across all developed and emerging markets shows a very different, well-diversified picture. The top left stock below is Microsoft at 2.2% of the market. It is worth noting that Microsoft’s market capitalisation is over US$1 trillion, compared to HSBC’s US$150 billion. HSBC now represents only 0.3% of the global market. Astute investors’ portfolios hold material allocations to non-UK equities.

Figure 2: Global exposure reduces specific stock risk

Data source: Morningstar Direct © All rights reserved. MSCI ACWI Index.

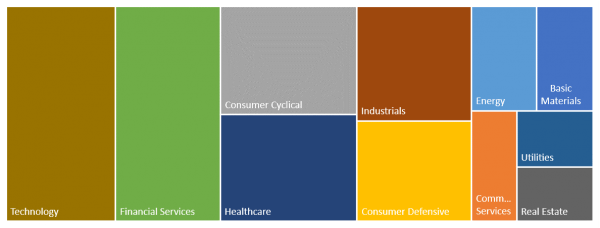

Business sector diversification also makes good sense. Owning a material allocation to global stocks ensure that sector exposures are diversified. The UK has some large sector allocation differences compared to the world as a whole; in particular it has no major technology companies like Microsoft, Amazon and Google, despite technology stocks representing around 15% of global equity markets. UK exposure to technology stocks is less than 3%. It also has material overweights to the energy and basic material sectors. The chart below illustrates the diversified sector weights across developed and emerging markets.

Figure 3: Global sector diversification makes good sense, more closely reflecting the global economy

Data source: Morningstar Direct © All rights reserved. MSCI ACWI Index.

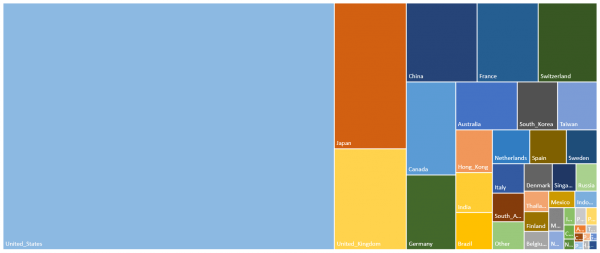

Diversifying on a global basis ensures that the impact of adverse movements in the UK equity market are reduced. The diagram below illustrates the 5% allocation to the UK in a globally diversified portfolio owning developed and emerging market equities on a market-capitalisation weight.

Figure 4: Global diversification materially reduces UK specific risk

Data source: Morningstar Direct © All rights reserved. MSCI ACWI Index.

Portfolio structure and Brexit

Looking beyond the equity markets, portfolios are well-positioned for Brexit.

Owning non-Sterling assets and currencies provides a hedge against a fall in the value of Sterling

In the event that Sterling is hit hard, as a possible consequence of a chaotic Brexit, it is worth remembering that the overseas equities in portfolios come with the currency exposure linked to those assets. For example, owning US equities comes with US dollar exposure, as this exposure is not hedged out. In short, a fall in Sterling will have a positive effect on non-UK assets that are unhedged, as the value of these overseas assets buy more Sterling when valued in Sterling terms.

Owning high quality, shorter-dated global bonds provides strong diversification

High quality bonds act as a strong insurance policy against falls in equity markets. Avoiding over-exposure to lower quality (e.g. high yield, sub-investment grade) bonds makes sense as they tend to act more like equities at times of economic and equity market crisis. Bond holdings diversified across a number of different global bond markets, mitigates the risk of a rise in UK yields (and thus falling prices), as the cost of borrowing in other markets may not be impacted in the same way, at the same time.

Portfolios already have strong structural validity based on inalienable truths

Brexit and the political chaos that we see before us, combined with the polarisation of politics between quasi-Marxist policies on the left and populist rhetoric on the right, is unsettling for all. We are where we are, unfortunately, whatever one’s Brexit views or political persuasion. Yet there are commonalities that in all client portfolios such as broad diversification, excellently managed, lower cost products and high quality bonds, that we can all rely on to see us through this mess. If it ain’t broke, don’t fix it. Portfolios are as well positioned as they can be for whatever lies ahead. Please try not to worry too much about your portfolio. It is in good shape.

This article was guest-written for us by Tim Hale, of Albion Strategic, and author of Smarter Investing.

Other notes and risk warnings

Use of Morningstar Direct© data

© Morningstar 2018. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.