If you can keep your head

David Crozier

The media do love a good headline, don’t they, especially when it’s out of context.

Yes, markets are down around the globe, but to read the headlines one would think that this is totally unprecedented, and that the world that we know it is about to end.

This morning’s BBC News headline is, “London shares hit lowest level since 2016”. While that is factually accurate, it could easily be read in other ways.

What about,

“Everybody that has held London shares since before 2016 has made money.”‡

And that doesn’t even include the dividends that have been paid out in the interim. Anybody that is holding equities, or other risky assets, with a two year objective in mind hasn’t been listening.

Yesterday’s news was “US stocks suffer biggest ever fall”.

While again accurate in terms of points on the major indices, this was very misleading – the actual drop was less than 5%, which was significantly less than some of the one-day falls in 2008 and 2009, and very far behind the 22% plus fall in October 1987.

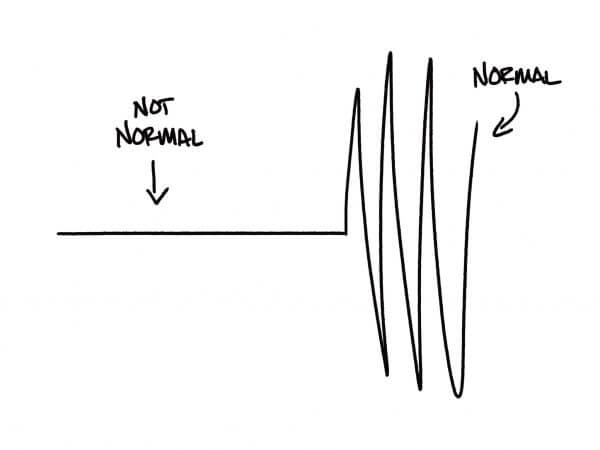

I do appreciate that market volatility is never pleasant, but it is normal with risky assets. We have enjoyed an unprecedented year or so when volatility has been unusually low, which tends to lull us into a false sense of what is normal. As my friend Carl Richards† puts it so elegantly:

Remember also that all Navigator’s clients have a diversified portfolio, and the defensive assets appear to be doing their stuff so far. The yield in Treasury bonds, aka gilts, has fallen a little, pushing up their price which, while it won’t completely offset the fall in equity prices will at least be acting as the shock-absorber we expect them to be.

My message to you, as always in these circumstances, is that now-hackneyed phrase, Keep calm and carry on. We are in this together for the long term, not just the next couple of months or even the last two years.

And spare a thought for those that have speculated in BitCoin. From a high in the middle of December they have lost nearly 70%* of the value of their asset in US dollar terms. With no dividends to soften the blow. That’s real money that is unlikely to come back, and this time I take no pleasure in being right.

As ever, if you have any queries or concerns, please do get in touch with myself or one of the other planners at Navigator Financial Planning on 028 3085 1199 and we will do our best to help.

*Source: coindesk.com

†Picture credit: Carl Richards, behaviorgap.com

‡Accurate as of 9am on 6th February. The value of real assets is subject to change and can fall as well as rise.